michigan sales tax exemption number

Streamlined Sales and Use Tax Project. Use tax is a companion tax to sales tax.

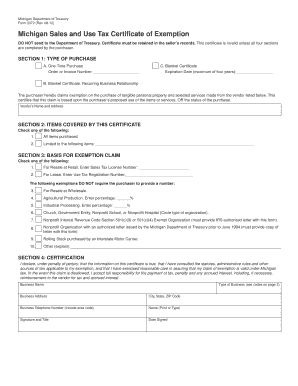

Fillable Online Mi 3372 Michigan Sales And Use Tax Certificate Of State Of Michigan Mi Fax Email Print Pdffiller

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

. Direct Pay -Authorized to pay use tax on qualified transactions directly to Michigan Treasury under account number. This exemption claim should be completed by the purchaser provided to the seller. Michigan does not issue tax exemption numbers.

Michigan does not issue tax exempt numbers and a seller may not. Ad Lookup State Sales Tax Rates By Zip. 2022 Sales Use and Withholding Taxes MonthlyQuarterly Return.

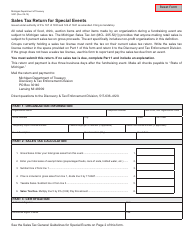

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Sales Tax Return for. Warren Schauer Michigan State University Extension - March 20 2013.

2021 Sales Use and Withholding Taxes MonthlyQuarterly Return. Online Application For fastest. A purchaser who claims exemption for resale at.

Michigan Sales and Use Tax Certificate of Exemption. Family-Run Business With Over 20 Years Proven Experience Shop Our Top Sellers Here. State University Extension will often get phone calls from farmers.

Ad Sales Tax Exemption Michigan Wholesale License Reseller Permit Businesses Registration. Enter Sales Tax License Number. Sales Tax Return for.

Wholesale trade shows and merchandise marts usually require a state sales tax identification number in order to allow your business to participate. Form Number 2021 Form Name. Ad Highest Quality Senior Facility Products At The Best Prices Bulk Wholesale Specials.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use tax. Michigan sales tax and farm exemption. Download tax rate tables by state or find rates for individual addresses.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Once you have that you are eligible to issue a resale certificate. Michigan is uncommon in having only one Tax exemption.

The Michigan Sales and Use Tax Exemption Certificate can be used to purchase any of the tax exempt items in Michigan. Exemption entities may complete the. If the retailer is.

Be cautious farmers should not use their social security number as proof for a. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Free Unlimited Searches Try Now.

Several examples of exemptions to the states sales tax are vehicles. Sales Tax Exemption Michigan Simple Online Application. Ad Sales Tax Exemption Michigan Wholesale License Reseller Permit Businesses Registration.

Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. Enter Use Tax Registration Number_____ 2. Enter Sales Tax License Number.

Sales Tax Exemption Michigan Simple Online Application. Michigan Department of Treasury 3372 Rev. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate. Sellers should not accept a number as evidence of exemption from sales or use tax. A Resale Certificate is obtained by filling out Form 3372 from the Department of Treasury titled Michigan Sales and Use Tax.

How do I get a tax exempt number in Michigan. _____ The following exemptions DO NOT require the purchaser to provide a number. Sellersare required to maintain records paper or electronic of completed exemption certificates for a period of four years.

For Resale at Retail. This license will furnish a business with a unique Sales Tax Number otherwise referred to as a Sales Tax ID number. Notice of New Sales Tax Requirements for Out-of-State Sellers.

Michigan Sales and Use Tax Certificate of Exemption. Form Number Form Name. To clarify there is no such thing as a sales tax exemption number for agriculture.

The Michigan Department of Treasury does not issue tax exempt numbers. How do I obtain a tax exempt number to claim an exemption from Sales or Use Tax. Ranked 21st highest by per capita revenue from the statewide sales tax 852 per capita Michigan has a statewide sales tax rate of 6 which has been in place since 1933.

Mi Mi W4 2020 2022 Fill Out Tax Template Online

Fillable Online Mi 3372 Michigan Sales And Use Tax Certificate Of State Of Michigan Mi Fax Email Print Pdffiller

Form 3421 Download Fillable Pdf Or Fill Online Sales Tax Return For Special Events Michigan Templateroller

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption

Exemptions From The Michigan Sales Tax

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption